For years, the argument was simple: “Ethereum is secure but expensive; Solana is fast but unstable.”

In 2026, that narrative is dead.

With the massive success of Ethereum’s “Dencun” upgrade and the explosion of Layer 2 networks like Base and Arbitrum, the gap has narrowed. We are no longer comparing $50 fees to $0.01 fees. We are now in a “War of Pennies.”

I’m Mei Lin, lead analyst at CoinProfit101. Today, I am ignoring the tribalism on Twitter. I am looking at the on-chain data to answer one question: Where should you actually trade to save money?

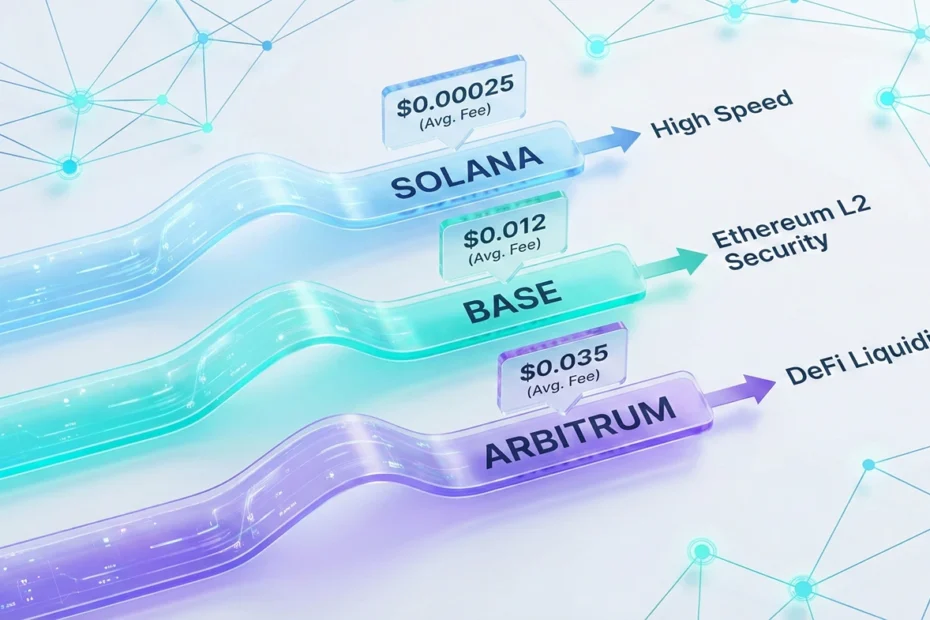

2026 Fee Snapshot:

I tracked average swap costs across three major networks over the last 30 days:

- Solana (SOL): $0.00025 per transaction.

- Base (L2): $0.012 per transaction.

- Arbitrum One (L2): $0.035 per transaction.

Verdict: Solana is still 40x cheaper, but for the average user, both feel “free.”

The Contender: Solana (The “Formula 1” Car)

Solana remains the undisputed king of raw speed. With a “Monolithic” architecture, it processes transactions on a single layer, aiming for thousands of transactions per second (TPS).

The Data: In Q1 2026, Solana averaged 2,500 – 4,000 real TPS (excluding vote transactions). This makes it the preferred home for “High Frequency” activities:

- Memecoin Trading: You need sub-second speed to snipe tokens.

- DePIN (Decentralized Physical Infrastructure): Projects like Helium running millions of micro-transactions.

- Gaming: On-chain games cannot wait 2 seconds for a block to clear.

Helpful Hint:

The “Failed Transaction” Myth: While Solana is fast, it historically struggled with “dropped” transactions during high traffic. In 2026, the Firedancer upgrade has fixed most of this, but you may still see failed swaps during massive memecoin launches. Always set your “Slippage” correctly.

The Challenger: Base (The “Corporate Giant”)

Base is Ethereum’s answer to Solana. Built by Coinbase, it is a “Layer 2” Rollup. It processes transactions off-chain and then “rolls them up” to settle on Ethereum later.

Why it’s winning market share: It isn’t just about the tech; it’s about distribution. Base has direct integration with Coinbase’s 110 million users. If you are moving money from a bank account to DeFi, Base is often the path of least resistance.

When comparing Solana vs Ethereum Layer 2 networks like Base, you trade a tiny bit of speed (Base takes ~2 seconds to confirm) for the massive security of the Ethereum network.

The Heavyweight: Arbitrum (The “DeFi Giant”)

If Base is for retail and Solana is for speed, Arbitrum One is for the “Whales.”

As the oldest and largest Layer 2 by Total Value Locked (TVL), Arbitrum has become the home of serious financial products. This is where you find complex derivatives, options markets, and “yield farms” that manage billions of dollars.

The Cost of Complexity:

Arbitrum is slightly more expensive than Base. Why? Because it is arguably more decentralized and processes more complex smart contract interactions. A simple swap might cost $0.02, but opening a leveraged position on a perp exchange could cost $0.10 – $0.20.

For a user moving $50,000, paying 10 cents is irrelevant. But for a user moving $10, it adds up.

The 2026 Comparison Matrix

Stop guessing. Here is the raw data I collected this month.

| Metric | Solana (SOL) | Base (L2) | Arbitrum (L2) |

|---|---|---|---|

| Avg. Swap Cost | $0.00025 | $0.012 | $0.035 |

| Real TPS | 3,500+ | 45 | 25 |

| Top Use Case | Memecoins & Gaming | Retail Payments | DeFi & Derivatives |

| User Profile | “Degens” & Traders | Beginners | Institutions |

Mei’s Verdict: Which Chain Should You Use?

There is no single winner. It depends on your bankroll.

- If you trade under $1,000: Use Solana.The fees on Base or Arbitrum (though small) will still eat 1-3% of your portfolio over a year of active trading. Solana allows you to make 100 trades for a penny. It is the only logical place for small accounts.

- If you want “Set & Forget” Savings: Use Base.

If you are just buying ETH or USDC to hold, Base is unbeatable. You can withdraw directly from Coinbase to your wallet for free, and the security guarantees are higher than Solana’s. - If you are a DeFi Professional: Use Arbitrum.

The deepest liquidity and the best “Yield Farming” opportunities (see Alex’s guide on staking) are still on Arbitrum. The 5-cent fee is a small price to pay for access to professional-grade tools.

FAQs

Mei Lin is a Senior Market Data Analyst at CoinProfit101.com, where she tracks institutional capital flows and macroeconomic trends affecting the digital asset market. With an eye for on-chain data and the “Digital Gold” thesis, Mei breaks down how global events and ETF developments impact long-term Bitcoin adoption. Her work focuses on providing objective, data-driven insights that help investors look past short-term noise to understand the broader market cycle. Mei is passionate about financial literacy and making high-level market analysis accessible to the 101-level investor.