If you only buy Bitcoin on Coinbase, doing your taxes is easy. You download a PDF, give it to your accountant, and you’re done. You can probably stop reading right now.

But you aren’t here because you buy Bitcoin on Coinbase. You are here because you are a DeFi User.

You have bridged ETH to Base, provided liquidity on Uniswap v4, staked SOL on Jito, and claimed airdrops on chains most people haven’t heard of. To the IRS, your wallet looks like a crime scene. To standard tax software, it looks like a glitch.

The stakes are higher in 2026. The IRS has rolled out Form 1099-DA for centralized exchanges, which means they now have “eyes on” the on-ramps and off-ramps. If you transferred $10,000 from Coinbase to MetaMask, traded it into a million pieces on Solana, and then transferred $12,000 back to Coinbase… the IRS only sees the entry and the exit. They will ask what happened in the middle.

I’m Alex Sterling. I have tested the top tax engines with a complex “Degen” wallet containing 5,000+ transactions across 12 chains. Today, we answer one question: Which software actually works for DeFi?

The DeFi Stress Test:

We tested both platforms against the “Trifecta of Pain”—the three things that usually break tax software:

- Bridging: Moving assets between L1 and L2 (does it trigger a tax event?).

- Liquidity Pools (LPs): Trading tokens for an LP receipt token.

- Rebasing Tokens: Staked assets that grow in quantity automatically (like stETH or aTokens).

The Core Problem: Why DeFi Breaks Normal Tax Software

Before we compare the tools, you need to understand why this is so hard. When you buy a stock on Robinhood, you get a clean “Buy” and “Sell” receipt. In DeFi, nothing is that simple.

The “Wrapped Token” Trap

Did you know that in the eyes of the IRS, wrapping ETH to WETH is technically a taxable event? It is treated as a “Crypto-to-Crypto” trade. If you wrap 10 ETH when the price is $3,000, and you bought that ETH years ago at $500, you just triggered a capital gains tax event on $25,000 of profit. Most software misses this nuance, but the best ones catch it.

The “Receipt Token” Confusion

When you deposit USDC into Aave, you don’t just “deposit” it. You actually swap your USDC for a token called aUSDC. This is a trade. If the software marks this as a “Sale” of your USDC, you could owe taxes on gains you haven’t realized yet. You need software that recognizes this as a non-taxable “Deposit” or “Liquidity” event.

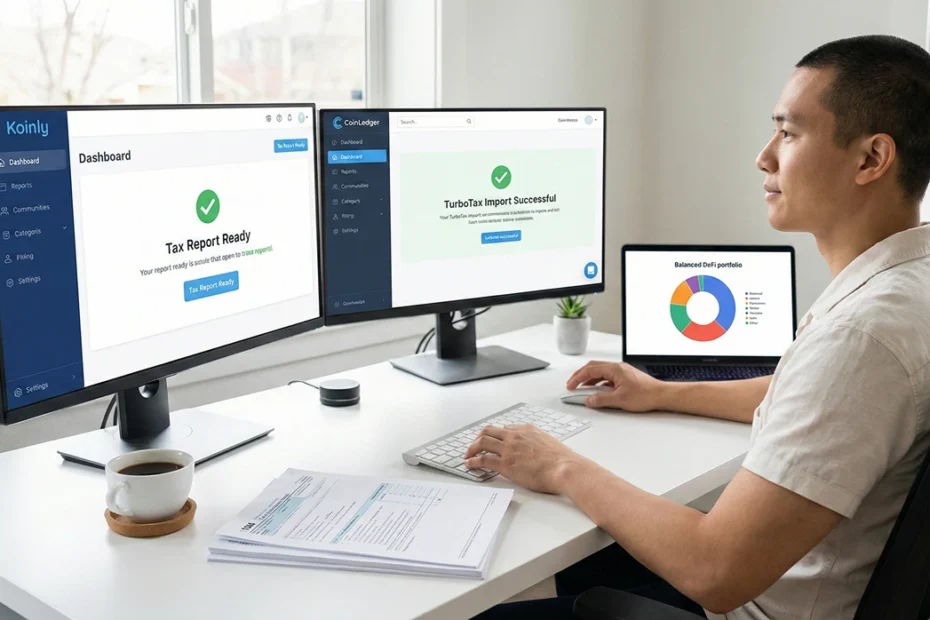

1. Koinly (The DeFi Heavyweight)

Koinly is widely considered the “Gold Standard” for DeFi users, and for good reason. It doesn’t just look at your wallet address; it attempts to understand the smart contracts you interacted with.

How It Handles DeFi:

- Liquidity Pools: Koinly automatically detects when you swap tokens for an LP position. Instead of marking it as a “Sale” (taxable), it often correctly labels it as a “Liquidity In” event (non-taxable until withdrawal, depending on jurisdiction). This prevents you from paying taxes on “phantom” gains.

- Chain Support: It supports over 800+ integrations. If you are farming on a new Layer 2 like Monad or MegaETH, Koinly is usually the first to add support.

- The “Aggregator” Logic: If you use a DEX aggregator like Jupiter or 1inch, Koinly sees through the router contract to identify the actual tokens you swapped. Other software sees “Interaction with Contract 0x123” and gives up.

Why DeFi Users Love It

- Free Preview: You can import your 10,000-transaction disaster wallet and see the calculated tax bill before you pay a cent. This is crucial for verifying if the tool can actually handle your specific blockchains.

- Smart Tagging: It allows you to manually tag transactions as “Reward,” “Staking,” “Swap,” or “Lost.” This flexibility is essential for cleaning up messy data.

- Error Handling: It flags “Missing Purchase History” clearly, allowing you to manually fix that one bridge transaction that didn’t sync.

The Downside

- Price for Volume: DeFi users generate a lot of transactions. Every approval, every claim, every swap counts. Koinly’s pricing scales by transaction count. If you have 10,000+ txs, you will be paying $279+ per year.

2. CoinLedger (The Challenger)

Formerly CryptoTrader.Tax

CoinLedger started as a tool for Coinbase users, but in 2025/2026, they aggressively pivoted to DeFi. They now support direct wallet imports for Solana, Ethereum, and Arbitrum.

How It Handles DeFi:

- NFTs: CoinLedger is actually superior to Koinly for NFT traders. It pulls metadata faster and handles “Minting” costs more accurately. If your “DeFi” strategy involves flipping NFTs on Magic Eden, CoinLedger is the winner.

- The UI: It is much cleaner. If Koinly looks like a spreadsheet, CoinLedger looks like a modern fintech app. For simple DeFi (e.g., just staking on Aave), it is easier to use.

- TurboTax Integration: It has the smoothest pipeline to TurboTax of any competitor. It is the “Official Partner,” meaning the data transfer is less likely to break.

Why It Struggles with Deep DeFi

- Obscure Chains: If you are on a niche chain (like a Cosmos app-chain or a new ZK-rollup), CoinLedger often forces you to upload a CSV manually. Koinly likely supports it natively.

- LP Confusion: In my testing, CoinLedger sometimes marked LP deposits as “Trades” (taxable events), requiring me to manually re-tag them. This can take hours if you have hundreds of LP positions.

Which One for You?

Koinly

If you are a true DeFi user—meaning you use bridges, aggregators, and yield farms—Koinly is the only choice. It detects the messy smart contract interactions that other software misses. The ability to preview your data for free is the killer feature that lets you audit the tool before you commit.

CoinLedger

If your “DeFi” activity is limited to buying NFTs on OpenSea or staking SOL in Phantom, CoinLedger is a better experience. It is cheaper, prettier, and integrates perfectly with TurboTax. Just don’t ask it to calculate taxes on a looped leverage position on Arbitrum.

The 3 Biggest DeFi Tax Traps of 2026

Software helps, but it can’t fix bad strategy. Here are the three most common mistakes I see clients make.

1. The “Impermanent Loss” Deduction Myth

Many users think, “My Liquidity Pool position is down 20% due to Impermanent Loss, so I can deduct that 20% from my taxes.”

Wrong. Impermanent Loss is unrealized. You cannot claim a loss on it until you actually withdraw your liquidity from the pool and sell the tokens. Until you exit the pool, that loss is just a number on a screen. Do not try to deduct it early, or you will get audited.

2. The “Rug Pull” Write-Off

You bought a memecoin. The developer rug-pulled. The token is now worth $0.000001. You want to claim a $5,000 Capital Loss.

The problem? You still own the tokens. The IRS does not allow you to claim a loss on an asset you still hold, even if it is “worthless.” You must dispose of the asset to trigger the loss.

The Fix: You need to send the worthless tokens to a “Burn Wallet” (a verifiable address that no one controls, like 0x000...dead). This counts as a disposal for $0, legally cementing your $5,000 loss.

3. The Airdrop Cost Basis

When you receive an airdrop (like JUP or ARB), it is taxed as Income based on the fair market value at the exact second it hits your wallet.

Example: You claim an airdrop worth $10,000. The price crashes to $2,000 the next day.

The Trap: You owe Income Tax on $10,000 (potentially $3,000+ in tax). You currently only have $2,000 worth of tokens. If you don’t sell immediately to cover the tax bill, you can end up owing more in taxes than the tokens are worth. Always set aside 30% of any airdrop for taxes immediately.

Frequently Asked Questions for DeFi Users

Alexander is a cryptocurrency researcher and the creator of CoinProfit101.com. Driven by a passion for decentralized finance and macroeconomics, He focuses on the intersection of institutional adoption and Bitcoin’s “Digital Gold” thesis. His goal is to provide a “101-level” entry point for complex financial topics, ensuring that new investors have the data-driven tools needed to succeed in the 2026 market. Alex holds a deep interest in cold storage security and long-term wealth preservation strategies.