You have bought the coins. You have secured the wallet. Now, you have a choice.

You can let your assets sit there collecting dust, or you can make them work for you. In 2026, the “Passive Income” economy in crypto is worth billions, but it is also a minefield of confusing terms and hidden risks.

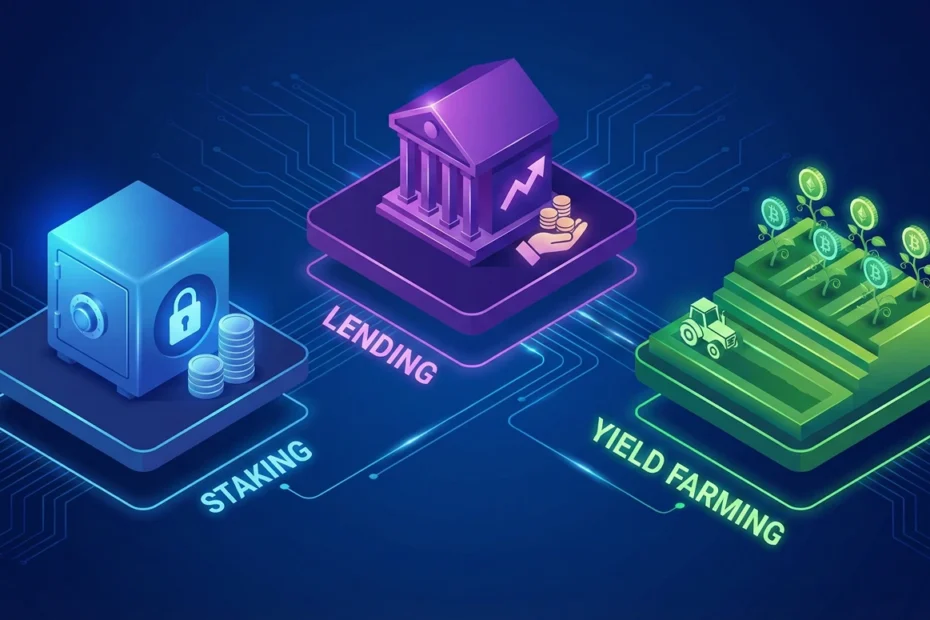

I’m Alex Sterling. Today, we are going to cut through the jargon. We aren’t just comparing staking vs yield farming vs lending; we are ranking them by safety.

Stats:

The average savings account in the US pays 0.5% interest. The average “safe” stablecoin yield in crypto is currently 5% to 8%. That is a 10x difference just for understanding how to click a few buttons.

Level 1: Staking (The “Savings Account”)

Risk Profile: Low | Difficulty: Beginner

Staking is the bedrock of the crypto economy. When you stake, you are effectively “locking” your coins (like Ethereum, Solana, or Cardano) to help secure the blockchain network. In exchange for your security service, the network pays you a reward.

Why it’s safe: You are not giving your money to a company or a bank. You are participating in the protocol itself. As long as you use a reputable validator (or do it yourself), the risk of losing your principal is near zero.

- Pros: predictable rewards, supports the network, very low risk of loss.

- Cons: Your funds are usually “locked” for days or weeks (e.g., 21 days for Polkadot).

Level 2: Lending (The “Banker” Model)

Risk Profile: Medium | Difficulty: Intermediate

If Staking is like a government bond, Lending is like being a bank. You deposit your crypto (usually Bitcoin or USDC) into a platform like Aave or Compound. Other users borrow your money and pay you interest.

The Risk Factor: In staking vs yield farming vs lending, lending carries “Counterparty Risk.” If the platform gets hacked, or if the borrowers default during a market crash, you could lose funds. However, modern DeFi protocols are “Over-Collateralized,” meaning borrowers must lock up $150 of value to borrow $100 of your money, making it much safer than it used to be.

Helpful Hint:

Don’t chase high APY. If a lending platform offers you 20% interest on USDC when the market rate is 5%, run away. That is not a yield; that is a Ponzi scheme waiting to collapse.

Level 3: Yield Farming (The “Venture Capital” Model)

Risk Profile: High | Difficulty: Expert

This is the Wild West. In the debate of staking vs yield farming vs lending, this is where the massive gains—and massive losses—happen.

Yield Farming (or Liquidity Mining) involves providing two assets to a decentralized exchange (like Uniswap). For example, you deposit $1,000 of ETH and $1,000 of USDC. You become a “market maker,” and you earn fees every time someone trades between those two tokens.

The Trap: Impermanent Loss

If the price of ETH skyrockets while USDC stays stable, the automated pool sells your ETH early to keep the ratio balanced. You end up with more USDC and less ETH than you started with. Often, you would have made more money just holding the coins in your wallet.

Helpful Hint:

Gas Fee Warning: Harvesting your yield rewards costs “gas” (network fees). If you are farming with less than $5,000, the fees to claim your rewards might be higher than the rewards themselves! (Read our Gas Fees vs. ETF Guide to understand network costs better).

The “Lazy Millionaire” Comparison Matrix

Here is the breakdown at a glance. Choose the strategy that fits your sleep schedule.

Staking (Safest)

- APY: 3% – 7%

- Risk: Very Low

- Best For: Beginners & “Hodlers” who want zero stress.

- Downside: Assets are locked for weeks.

Yield Farming (Riskiest)

- APY: 10% – 100%+

- Risk: High (Impermanent Loss & Smart Contract bugs)

- Best For: Experts with $10k+ portfolios.

- Downside: Requires constant monitoring.

Alex’s Strategy: The “80/20” Rule

My advice? Don’t go all-in on one strategy. Use the 80/20 rule:

- Put 80% of your stack into Staking or cold storage (Safety first).

- Put 20% into Lending/Farming to chase higher yields.

And remember: Passive income is great, but it complicates your estate planning. If you die with funds locked in five different liquidity pools, your family will never find them. Make sure you update your Crypto Inheritance Plan every time you start a new farm.

FAQs

Alexander is a cryptocurrency researcher and the creator of CoinProfit101.com. Driven by a passion for decentralized finance and macroeconomics, He focuses on the intersection of institutional adoption and Bitcoin’s “Digital Gold” thesis. His goal is to provide a “101-level” entry point for complex financial topics, ensuring that new investors have the data-driven tools needed to succeed in the 2026 market. Alex holds a deep interest in cold storage security and long-term wealth preservation strategies.